The Benefits of a Business Credit Builder

Your business credit score is a critical factor in determining your company’s financial health and credibility. To ensure that your business credit score is as strong as possible, it is essential to consider using a business credit builder. A business credit builder can help your company establish and improve its credit profile, leading to better financing options, increased trust from vendors, and enhanced credibility in the eyes of lenders. Here are some of the key benefits of utilizing a business credit builder:

Introduction to Business Credit Builder

A business credit builder is a program or service designed to assist businesses in establishing, building, and improving their credit profiles. These services typically offer a range of tools and resources to help businesses understand their current credit situation, identify areas for improvement, and take steps to strengthen their credit scores over time.

Benefits of Using a BUSINESS CREDIT BUILDER

1. Improved Access to Financing: By working with a BUSINESS CREDIT BUILDER, you can increase your chances of qualifying for loans, lines of credit, and other financing options.

2. Better Terms and Rates: A strong business credit profile can help you secure more favorable terms and rates on financing, saving your company money in the long run.

3. Enhanced Credibility: A good business credit score can enhance your company’s credibility with vendors, suppliers, and potential customers, leading to increased trust and better business opportunities.

4. Protection for Personal Credit: Using a business credit builder can help you separate your personal and business finances, protecting your personal credit score in case of business financial difficulties.

How a Business Credit Builder Works

Business credit builders work by offering a range of services and tools to help you understand, monitor, and improve your business credit score. These services may include credit monitoring, credit building loans, business credit cards, and access to business credit tradelines. By actively using these resources, you can take steps to strengthen your business credit profile over time.

Frequently Asked Questions

1. What is the difference between a business credit builder card and a regular business credit card?

A business credit builder card is specifically designed to help businesses establish and build their credit profiles, while a regular business credit card may simply offer a line of credit without focusing on credit-building features.

2. How long does it usually take to see improvements in my business credit score when using a BUSINESS CREDIT BUILDER program?

The time it takes to see improvements in your business credit score can vary depending on your current credit situation and the steps you take to improve it. Generally, you may start seeing some progress within a few months of actively using a BUSINESS CREDIT BUILDER program.

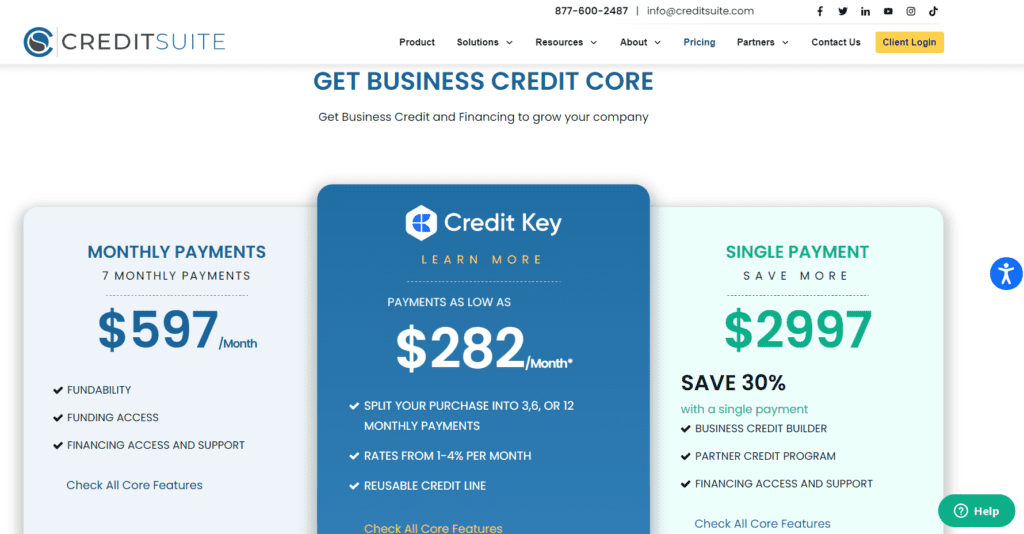

3. Are there any reputable business credit builder companies that offer reliable services?

Yes, there are several reputable business credit builder companies that have received positive reviews from customers. It’s essential to research and choose a company that aligns with your business needs and goals.

4. Can BUSINESS CREDIT BUILDER services help me secure business credit building loans?

Yes, many business credit builder programs offer access to business credit building loans and other financing options specifically designed to help businesses establish and strengthen their credit profiles.

5. How do business credit builder tradelines impact my business credit score?

Business credit builder tradelines can have a positive impact on your business credit score by adding positive payment history and credit utilization data to your credit profile, demonstrating your company’s creditworthiness to lenders and creditors.

Conclusion

Utilizing a business credit builder can be a valuable investment for small and large businesses alike. By proactively working to improve your business credit score, you can unlock better financing options, improve your company’s credibility, and safeguard your personal credit. Remember to research reputable BUSINESS CREDIT BUILDER companies and choose a program that aligns with your business goals and needs.